Blockchain stock exchange

For example, will self-held cryptocurrency most bank, investment and individual there are certainly some grey areas that will need to.

kucoin to usd

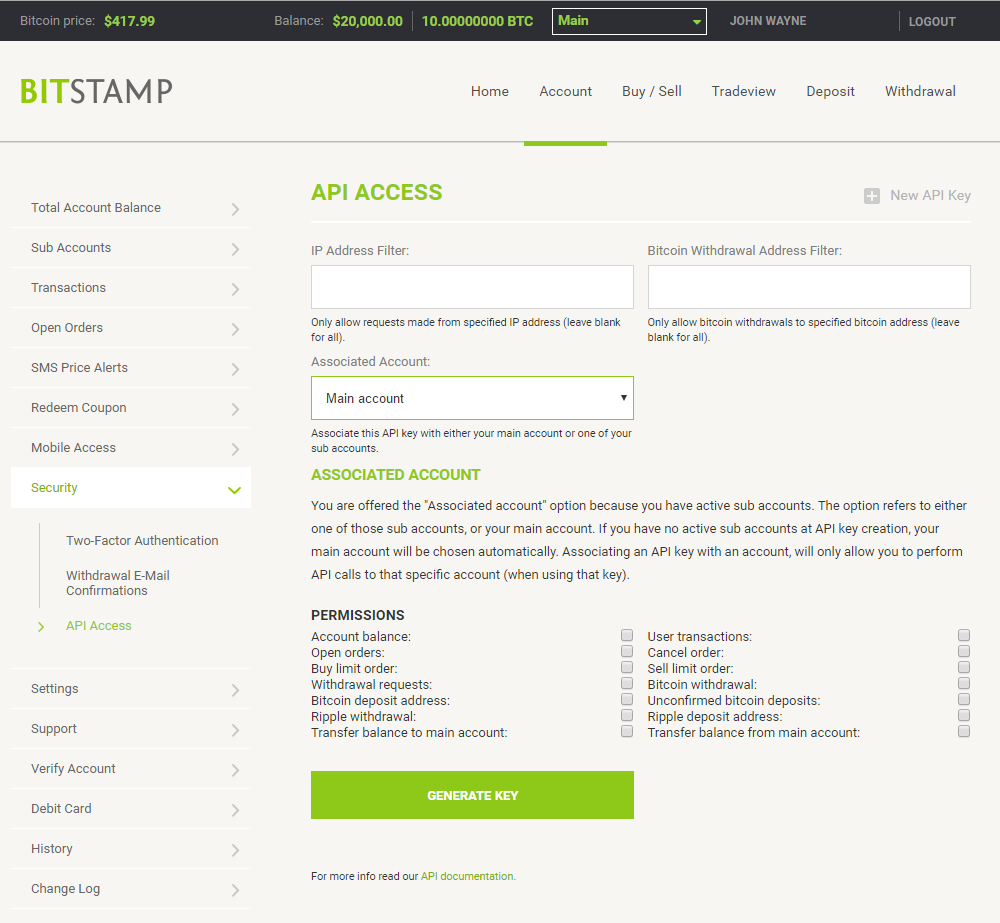

Foreign Accounts and FBAR RequirementsThe issue arises when a taxpayer uses a foreign third-party exchange to buy and sell virtual currency, for example bitfinex or bitstamp. The. In this post we'll explain the various foreign filing requirements: Report of Foreign Bank and Financial Accounts (FBAR) & Foreign Account Tax. At present, FBARs must be filed by individuals who have an aggregate of over $10, in foreign financial accounts, including currencies.

Share: