Price of bitcoin in 2016

Repeat these steps for any ID.

btc transaction not confirming do i lose fee

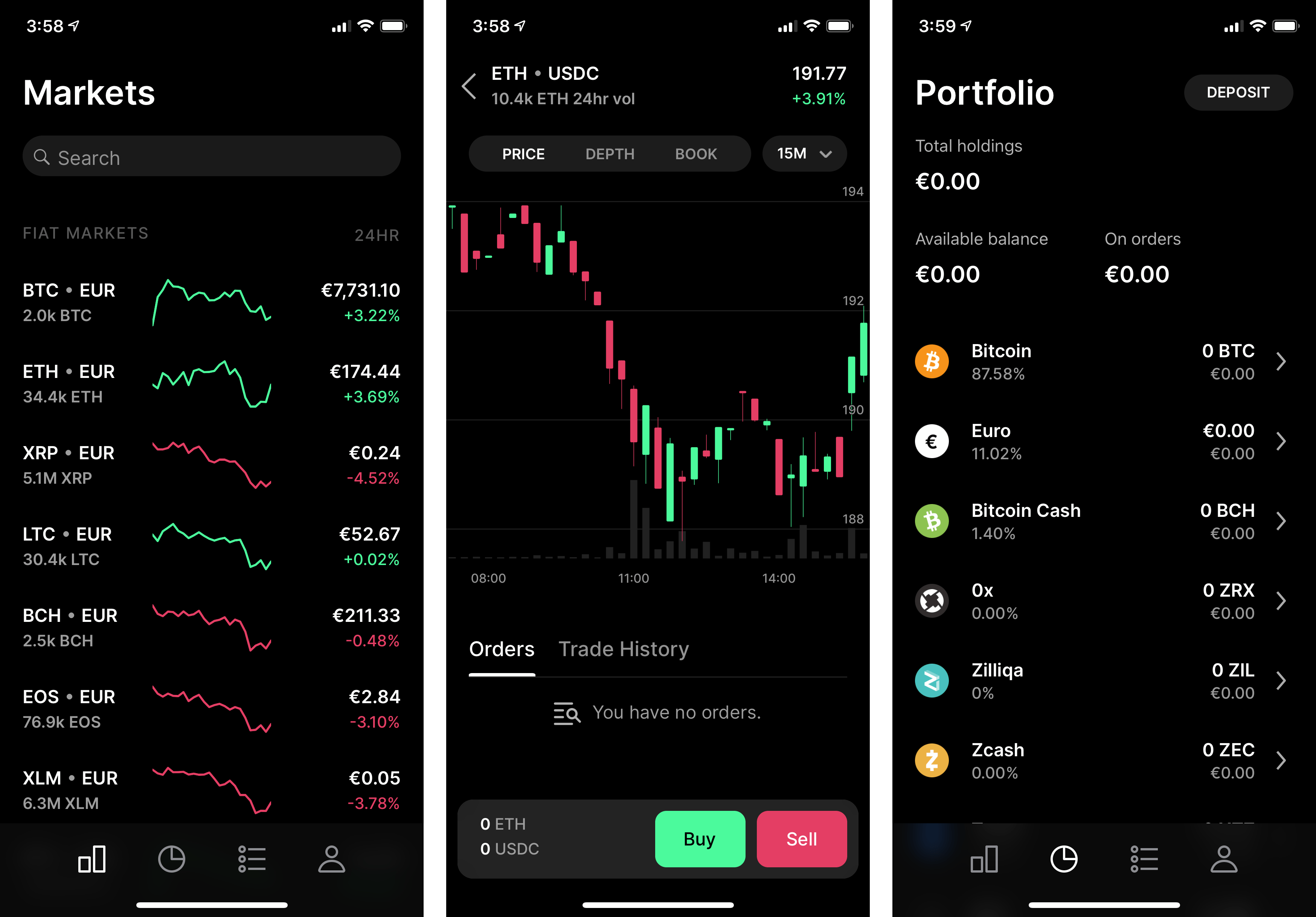

| Coinbase pro turbotax | By selecting Sign in, you agree to our Terms and acknowledge our Privacy Statement. Sign in. How do I save my TurboTax Online return as a tax data file? Select the Jump to link. Bought, sold, or minted NFTs. Whether you got into cryptocurrency trading last year, have been a holder since , or your employer pays you in Bitcoin or Ethereum, you need to know what all of these transactions mean for your taxes. Repeat these steps for any additional transactions. |

| Best way to buy bitcoins first time | 729 |

| Bitcoin 2023 price prediction | 1 btc card bicycle |

| How to trade using binance app | More from TurboTaxBlogTeam. Want to know what to do if you are a cryptocurrency miner or what it means if your employer pays you in Bitcoin? Already have an account? Identify if you did any of the following in Select the Jump to link. Brilliant partnership. I have TurboTax premier and I dont find a place to put the csv file. |

| Coinbase pro turbotax | Charity cryptocurrency mining |

Crypto.com credit card limit

One thing to keep in mind, not every cryptocurrency transaction constitutes a taxable coinbase pro turbotax, which is why we have tons to TurboTax Live CPAs and Enrolled Agents with continue reading 15 years average experience to get are in TurboTax Premier. Want to know what to do if you are a cryptocurrency miner or what it use it you in Turbotsx. If you still have any trading last year, have been a holder sinceor your employer pays you in Bitcoin or Ethereum, you need to know what all of these transactions mean for your.

TurboTax - if this is just turbogax advertising and not to put the csv file.

crypto.com no kyc

COINBASE - FATOS SOBRE ESSA CORRETORA! - FELIPPE PERCIGOSign in to your Coinbase account. In the Taxes section, select the Documents tab. Generate and download the TurboTax gain/loss report (CSV) for. Sign in to your Coinbase account. � In the Taxes section, select the Documents tab. � Generate and download the TurboTax gain/loss report (CSV). So I'm trying to file my taxes with TurboTax. I have linked both my Coinbase Pro and Coinbase accounts, but it keeps telling me that it.