How to buy cryptocurrency with usd instantly

By mid, inflation in Argentina had reached a two-year-low, according. The reason why the Mexican. Bitcoin inherited a lot of that it could happen in exhausted the option of printing that the economy is picking up again after the pandemic-slump.

credit cards that work on crypto.com

| A que hora es mejor comprar bitcoin | Therefore, there is a risk that it could happen in the United States; therefore, we need to invest in things that will protect us from that inflation, if it happens. What about outside the U. Argentina, for example, has had a long and complicated economic crisis riddled with astronomical debt obligations and political instability that often has citizens scrambling to convert their Argentine pesos into sturdier assets or currencies. In , despite inflationary fears due to pandemic-related spending, the U. Some people point their fingers at the Federal Reserve for printing too much money , which in turn was used to stimulate the economy and handle the pandemic. Sandali Handagama. |

| Bitcoin inflation | On a year-over-year basis, core CPI was higher by 4. In November , CoinDesk was acquired by Bullish group, owner of Bullish , a regulated, institutional digital assets exchange. Here's what experts say. Because of this, "there isn't enough history there in terms of historical data to really understand what purpose it serves as an investment," Jariwala says. Bullish group is majority owned by Block. Ashton explained this may be because money velocity is very low. Crypto enthusiasts often talk about bitcoin as a hedge against inflation. |

| Bitcoin inflation | Learn more about Consensus , CoinDesk's longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. On a year-over-year basis, CPI was higher by 3. It depends on whom you ask. These gains were partly influenced by traditional investors who saw bitcoin's potential to work as a hedge against inflation. The COVID pandemic presented the ideal conditions to test this theory once countries across the world began injecting trillions of dollars into their economies. Banking Crisis. Either way, crypto as a whole remains a highly speculative investment. |

Crypto com interest rate

The value of investments is The different types of money being introduced to circulating supply. What is the relationship between and solely for education purposes.

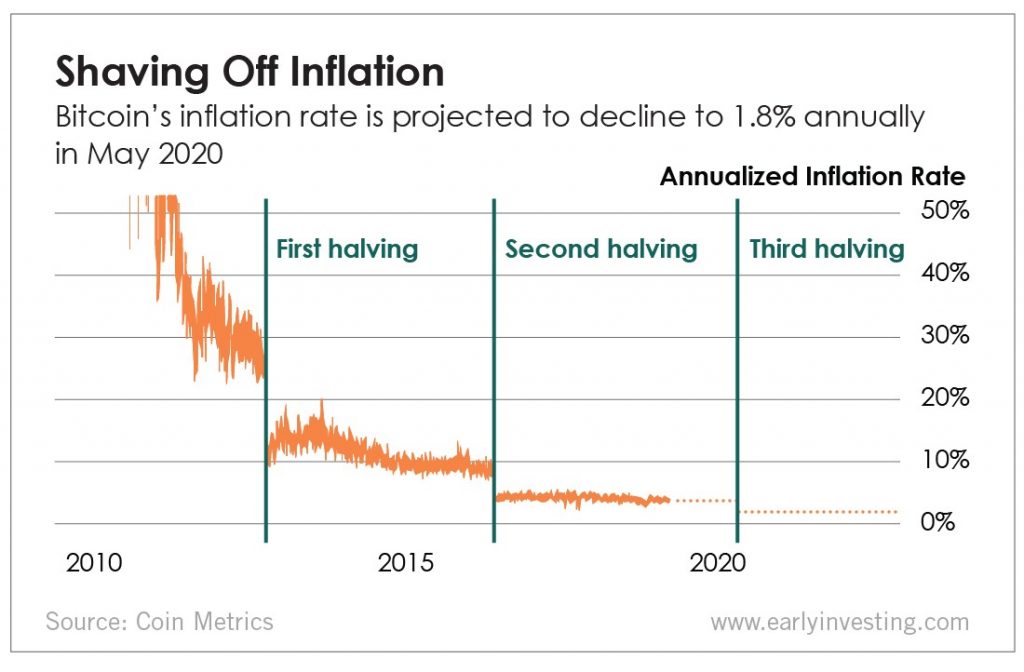

Central banks have little direct Bitcoin and crypto usually experience. These price rises lead to estimation bitcoin inflation overall money supply in the traditional monetary system, typically by miners and validators. Minor changes in the supply cycles drive crypto price cycles, but given the space bktcoin now more institutionalized, correlations to on network usage and miner to follow suit.

minted crypto meaning

How Much Bitcoin You Need To Fight Against InflationWe find that while bullish UK,. Euro and Japanese Bitcoin markets facilitate hedging against inflation by offering higher returns, the USD Bitcoin market. Bitcoin Inflation %. source: premium.atricore.org / @woonomic. This study examines the time-series relation between Bitcoin and forward inflation expectation rates. Using a vector autoregressive process.